As a Risk Manager, you will be expected to work from Monday to Friday between 9 and 5, although senior positions may have longer hours. In larger organisations, you can also expect to spend some time outside the office, visiting other sites and offices. Senior risk managers might also attend conferences. Expert risk managers can also create their own risk management company. The demand for risk managers will increase as the world becomes more globalized.

Position Description

As the Personal risk specialist, you will have to meet the needs of high net-worth clients. You will need to be meticulous, organized, and eager to establish strong client relationships. You will schedule appointments, visit clients, and provide advice and guidance on personal risk management options.

Responsible for the preparation of proposals on Executive Risk Management Prospects.

An analyst in risk management is responsible for analysing the risk environment and supporting documentation in order to create plans to reduce risks. They also review current risk management policies and procedures and prepare risk assessment reports and proposals. Candidates should have a degree, several years' experience and strong analytical skills to become risk management analysts.

For risk management professionals, there are a variety of salary ranges

Based on where they live, the salary ranges of risk management professionals can be very different. Entry-level positions usually earn between $86,000 and $107,000 per annum, with top earners earning over $170,000 annually. Entry-level risk management positions are typically less expensive than their counterparts in the insurance and finance fields. However, as the profession continues to expand, there are more opportunities for higher-paying roles in the field.

A risk management specialist can be expected to perform a variety of tasks, including monitoring and recording risks in enterprises and operations. They also collect data and put together risk-assessment tools. They may also produce reports and suggest mitigation strategies. Risk managers often have a PhD.

While risk management professionals share many of the same skills, they all have their own job titles. Some may be responsible for business development, while others may handle risk management. Both require knowledge in accounting, financial statements, customer service and accounting. Risk managers typically earn more than their counterparts, while administrators earn less than their counterparts.

FAQ

Who should use a Wealth Manager

Anyone who wants to build their wealth needs to understand the risks involved.

For those who aren't familiar with investing, the idea of risk might be confusing. As such, they could lose money due to poor investment choices.

It's the same for those already wealthy. It's possible for them to feel that they have enough money to last a lifetime. But this isn't always true, and they could lose everything if they aren't careful.

Therefore, each person should consider their individual circumstances when deciding whether they want to use a wealth manger.

What is wealth management?

Wealth Management can be described as the management of money for individuals or families. It encompasses all aspects financial planning such as investing, insurance and tax.

How to Beat Inflation With Savings

Inflation is the rise in prices of goods and services due to increases in demand and decreases in supply. It has been a problem since the Industrial Revolution when people started saving money. The government manages inflation by increasing interest rates and printing more currency (inflation). However, there are ways to beat inflation without having to save your money.

You can, for example, invest in foreign markets that don't have as much inflation. An alternative option is to make investments in precious metals. Silver and gold are both examples of "real" investments, as their prices go up despite the dollar dropping. Investors who are concerned about inflation are also able to benefit from precious metals.

What age should I begin wealth management?

Wealth Management is best done when you are young enough for the rewards of your labor and not too young to be in touch with reality.

The earlier you start investing, the more you will make in your lifetime.

You may also want to consider starting early if you plan to have children.

You may end up living off your savings for the rest or your entire life if you wait too late.

How to Begin Your Search for A Wealth Management Service

Look for the following criteria when searching for a wealth-management service:

-

A proven track record

-

Is the company based locally

-

Offers free initial consultations

-

Offers support throughout the year

-

A clear fee structure

-

Good reputation

-

It's easy to reach us

-

Offers 24/7 customer care

-

Offers a variety products

-

Low fees

-

Hidden fees not charged

-

Doesn't require large upfront deposits

-

Has a clear plan for your finances

-

Has a transparent approach to managing your money

-

This makes it easy to ask questions

-

Does your current situation require a solid understanding

-

Understand your goals and objectives

-

Is willing to work with you regularly

-

Works within your budget

-

A good knowledge of the local market

-

Would you be willing to offer advice on how to modify your portfolio

-

Is ready to help you set realistic goals

What is a Financial Planning Consultant? And How Can They Help with Wealth Management?

A financial advisor can help you to create a financial strategy. They can analyze your financial situation, find areas of weakness, then suggest ways to improve.

Financial planners are professionals who can help you create a solid financial plan. They can advise you on how much you need to save each month, which investments will give you the highest returns, and whether it makes sense to borrow against your home equity.

Financial planners are usually paid a fee based on the amount of advice they provide. Certain criteria may be met to receive free services from planners.

What are my options for retirement planning?

No. This is not a cost-free service. We offer free consultations, so that we can show what is possible and then you can decide whether you would like to pursue our services.

Statistics

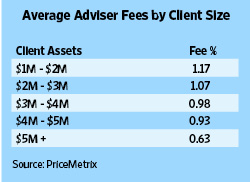

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

- US resident who opens a new IBKR Pro individual or joint account receives a 0.25% rate reduction on margin loans. (nerdwallet.com)

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

External Links

How To

How To Invest Your Savings To Make Money

You can get returns on your capital by investing in stock markets, mutual funds, bonds or real estate. This is what we call investing. It is important to understand that investing does not guarantee a profit but rather increases the chances of earning profits. There are many options for how to invest your savings. You can invest your savings in stocks, mutual funds, gold, commodities, real estate, bonds, stock, ETFs, or other exchange traded funds. These methods will be discussed below.

Stock Market

The stock market is an excellent way to invest your savings. You can purchase shares of companies whose products or services you wouldn't otherwise buy. You can also diversify your portfolio and protect yourself against financial loss by buying stocks. If the price of oil falls dramatically, your shares can be sold and bought shares in another company.

Mutual Fund

A mutual fund refers to a group of individuals or institutions that invest in securities. They are professional managed pools of equity or debt securities, or hybrid securities. The mutual fund's investment goals are usually determined by its board of directors.

Gold

Gold has been known to preserve value over long periods and is considered a safe haven during economic uncertainty. It is also used as a form of currency in some countries. Gold prices have seen a significant rise in recent years due to investor demand for inflation protection. The supply and demand factors determine how much gold is worth.

Real Estate

Real estate can be defined as land or buildings. Real estate is land and buildings that you own. Rent out a portion your house to make additional income. The home could be used as collateral to obtain loans. The home can also be used as collateral for loans. Before buying any type property, it is important to consider the following things: location, condition and age.

Commodity

Commodities are raw materials, such as metals, grain, and agricultural goods. Commodity-related investments will increase in value as these commodities rise in price. Investors who wish to take advantage of this trend must learn to analyze graphs and charts, identify trends and determine the best entry point to their portfolios.

Bonds

BONDS are loans between governments and corporations. A bond is a loan in which both the principal and interest are repaid at a specific date. When interest rates drop, bond prices rise and vice versa. A bond is purchased by an investor to generate interest while the borrower waits to repay the principal.

Stocks

STOCKS INVOLVE SHARES of ownership within a corporation. Shares represent a small fraction of ownership in businesses. Shareholders are those who own 100 shares of XYZ Corp. Dividends are also paid out to shareholders when the company makes profits. Dividends are cash distributions paid out to shareholders.

ETFs

An Exchange Traded Fund is a security that tracks an indice of stocks, bonds or currencies. ETFs are traded on public exchanges like traditional mutual funds. The iShares Core S&P 500 eTF, NYSEARCA SPY, is designed to follow the performance Standard & Poor's 500 Index. This means that if SPY was purchased, your portfolio would reflect its performance.

Venture Capital

Venture capital is private funding that venture capitalists provide to entrepreneurs in order to help them start new companies. Venture capitalists offer financing for startups that have low or no revenues and are at high risk of failing. Venture capitalists usually invest in early-stage companies such as those just beginning to get off the ground.