A 401k that does not charge a redemption fee makes a smart investment. You won't have pay out of pocket to get the money but you will still be able to enjoy all the benefits. You should be aware of some things before you pick a plan.

Investing in a 401k with a 0.50% annual fee

When investing in your retirement plan, you need to be mindful of the fees. There are generally two types of fees: plan fees and individual participant fees. Plan fees are used to cover the cost of administering the plan. Individual participant fees, on the other hand, are used for optional services. Before you choose which investment fund to invest, both fees will be deducted from your account.

Investment fees are typically charged as percentages of an account's balance. For example, if you have $50,000 to invest in a fund charged a 0.50% fee annually, you'll pay $300 in annual fees. The fees can quickly add up, and by the time you reach your retirement age, you could be looking at a fee of $3,000 a year. The fees could cut your savings by thousands.

A portfolio should reflect your financial goals. For example, if you want a higher return, you should invest more in stock funds. In addition, diversifying your portfolio is a good way to reduce risk and maximize your returns. Your risk tolerance should never be exceeded.

Low-cost investments are the best option if you want to have the lowest possible costs. Higher expenses might be more appealing to you if your tolerance for risk is higher. It could give you higher returns or access to a more experienced investment manager. You need to decide if you are comfortable paying the fees.

Investing in your 401k at a 2% annual cost

A 401(k), as long as there are no excessive fees, is often a good option. The annual fee for most plans is usually 1%, but some plans may charge higher. You should also remember that the amount you pay will affect your return. Your return on investment may be affected by the amount you pay. For example, if your 401(k has $50,000 and charges a 2% annual redeem fee, your return will be $500. Employers may agree to pay a portion of these fees, provided that the plan has a low cost ratio. This helps ensure that a large percentage of your contribution gets invested.

While many investors may not pay much attention to these fees, the fees on their 401(k)s can be a hidden cost. A recent TD Ameritrade survey showed that only 27% knew what their 401 (k) fees were. Fees can have a negative impact on your returns, which is why you should look for a plan with a low annual expense ratio.

Consider whether a plan in a 401k is a long-term one. The funds in your 401(k), while they should be saved for the long-term. However, you can liquidate them to obtain cash. If you are in urgent need of cash, you can borrow from your 401(k) account. This is money you can use for the rest your life.

FAQ

How to Select an Investment Advisor

The process of choosing an investment advisor is similar that selecting a financial planer. Consider experience and fees.

This refers to the experience of the advisor over the years.

Fees are the cost of providing the service. You should compare these costs against the potential returns.

It is important to find an advisor who can understand your situation and offer a package that fits you.

What is retirement plan?

Retirement planning is an essential part of financial planning. You can plan your retirement to ensure that you have a comfortable retirement.

Retirement planning is about looking at the many options available to one, such as investing in stocks and bonds, life insurance and tax-avantaged accounts.

How old do I have to start wealth-management?

Wealth Management should be started when you are young enough that you can enjoy the fruits of it, but not too young that reality is lost.

You will make more money if you start investing sooner than you think.

If you're planning on having children, you might also consider starting your journey early.

If you wait until later in life, you may find yourself living off savings for the rest of your life.

Who Should Use A Wealth Manager?

Everybody who desires to build wealth must be aware of the risks.

Investors who are not familiar with risk may not be able to understand it. As such, they could lose money due to poor investment choices.

It's the same for those already wealthy. They might feel like they've got enough money to last them a lifetime. But this isn't always true, and they could lose everything if they aren't careful.

Each person's personal circumstances should be considered when deciding whether to hire a wealth management company.

Statistics

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

- As previously mentioned, according to a 2017 study, stocks were found to be a highly successful investment, with the rate of return averaging around seven percent. (fortunebuilders.com)

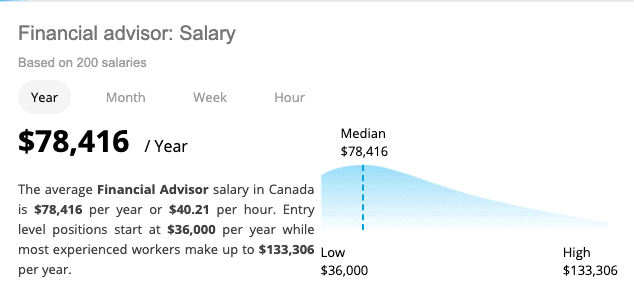

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

External Links

How To

How to invest once you're retired

When people retire, they have enough money to live comfortably without working. But how do they put it to work? It is most common to place it in savings accounts. However, there are other options. You could sell your house, and use the money to purchase shares in companies you believe are likely to increase in value. You can also get life insurance that you can leave to your grandchildren and children.

You should think about investing in property if your retirement plan is to last longer. You might see a return on your investment if you purchase a property now. Property prices tends to increase over time. You could also consider buying gold coins, if inflation concerns you. They don't lose their value like other assets, so it's less likely that they will fall in value during economic uncertainty.