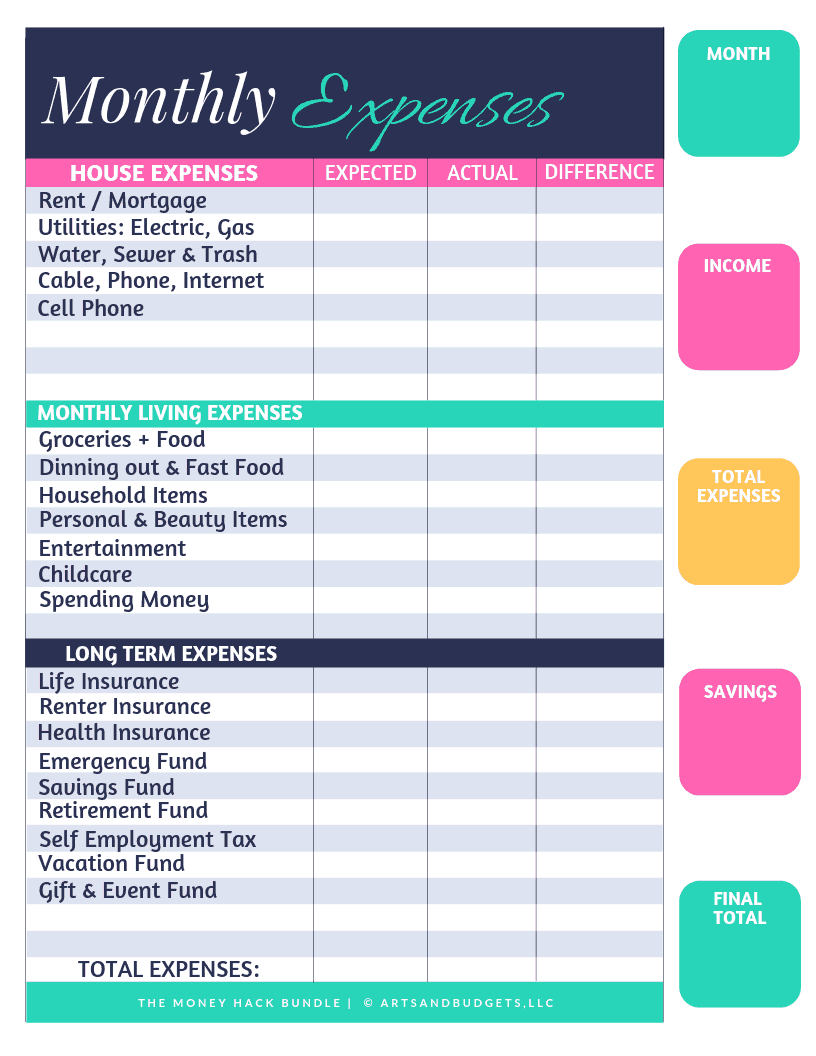

One of the most effective budgeting tips is to track your expenses, whether it be on a daily or monthly basis. You shouldn't set unrealistic spending goals or budget limits. Instead, keep a daily log of your spending to help you track where you spend the most. This will help to keep you on track, and also show you where savings can be made. Once you are aware of how much you spend, you can start to make a plan for saving it.

You should not be checking your spending daily or monthly.

Although it might seem like a great idea to keep track of your spending each day, this can lead to exhaustion and not being able to budget properly. Over-checking your budget can lead to a loss of control. Instead, make a habit of looking at your expenses three to six months after the last review. If your spending goals are different than what they are, this could indicate a spending leak. You can avoid this by adding some money to your checking account.

Avoid setting unrealistic savings goals or spending limits.

Budgeting is important because a small amount can result in a large sum. Spending should be allocated to needs, wants entertainment and dining out. Your budget should reflect these areas, but it is also important to allow some wiggle room. Your spending habits reflect your financial status. Therefore, it is best to allocate a portion to each expense.

Keeping track of all of your spending

You can increase your savings by tracking all your spending and keeping a budget. Every purchase you make, even groceries, should be kept track of for at the very least one week. This will let you see exactly where your money goes and what it's going to. Track your spending over a longer period of time. Because they track each transaction, credit cards and mobile apps are great tools for tracking your spending. You can also keep track of your spending by using hard-copy statements.

Tracking your spending for a week

When you're budgeting, tracking your spending for a week can help you make your plan more useful. Not only can you see where you're overspending, but it can also help you figure out where you can make cuts. You can spend more than $20 per week if you buy coffee every morning. Spend at least $15 per week if your lunch breaks include items purchased from vending machine machines. The Budget Calculator can tell you how much money you could save if you cut out these items.

Track your spending over the course of a month

Budgeting can be as simple as keeping track of your spending over a month. This will help you identify patterns and areas to improve. Perhaps you discover that you spend more than you make. This could be a sign that your lifestyle is not affordable. If you can't make these changes, a special category in your budget should be set up for one-time expenses. Ideally, you'll shift the money to savings once the month ends.

FAQ

How to Choose An Investment Advisor

The process of selecting an investment advisor is the same as choosing a financial planner. There are two main factors you need to think about: experience and fees.

An advisor's level of experience refers to how long they have been in this industry.

Fees refer to the cost of the service. These fees should be compared with the potential returns.

It is important to find an advisor who can understand your situation and offer a package that fits you.

Why is it important to manage wealth?

The first step toward financial freedom is to take control of your money. You must understand what you have, where it is going, and how much it costs.

Also, you need to assess how much money you have saved for retirement, paid off debts and built an emergency fund.

If you fail to do so, you could spend all your savings on unexpected costs like medical bills or car repairs.

What is risk management in investment management?

Risk Management refers to managing risks by assessing potential losses and taking appropriate measures to minimize those losses. It involves monitoring, analyzing, and controlling the risks.

A key part of any investment strategy is risk mitigation. The objective of risk management is to reduce the probability of loss and maximize the expected return on investments.

These are the main elements of risk-management

-

Identifying the source of risk

-

Monitoring the risk and measuring it

-

How to control the risk

-

Managing the risk

Statistics

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

- A recent survey of financial advisors finds the median advisory fee (up to $1 million AUM) is just around 1%.1 (investopedia.com)

- US resident who opens a new IBKR Pro individual or joint account receives a 0.25% rate reduction on margin loans. (nerdwallet.com)

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

External Links

How To

How to Beat Inflation With Investments

Inflation is one of the most important factors that influence your financial security. It has been observed that inflation is increasing steadily over the past few years. Each country's inflation rate is different. For example, India is facing a much higher inflation rate than China. This means that you may have some savings, but not enough to cover your future expenses. You may lose income opportunities if your investments are not made regularly. So, how can you combat inflation?

One way to beat inflation is to invest in stocks. Stocks are a great investment because they offer a high return of investment (ROI). These funds can also be used to buy real estate, gold, and silver. Before you invest in stocks, there are a few things you should consider.

First, decide which stock market you would like to be a part of. Do you prefer small or large-cap businesses? Choose accordingly. Next, you need to understand the nature and purpose of the stock exchange that you are entering. Do you want to invest in growth stocks or value stock? Then choose accordingly. Learn about the risks associated with each stock market. There are many types of stocks available in the stock markets today. Some stocks are risky, while others are more safe. Choose wisely.

Expert advice is essential if you plan to invest in the stock exchange. Experts will help you decide if you're making the right decision. Diversifying your portfolio is a must if you want to invest on the stock markets. Diversifying increases your chances of earning a decent profit. You run the risk losing everything if you only invest in one company.

A financial advisor can be consulted if you still require assistance. These professionals can help you with the entire process of investing in stocks. They will help ensure that you choose the right stock. You can also get advice from them on when you should exit the stock market depending on your goals.